There are two methods for adding consultants to a project and tracking their related fees-Reimbursable and Non-reimbursable. The following information provides details on how to use both methods. Choose the method that best suits your firm's billing methods.

This method is useful when a contract specifies that consultant service fees be passed on directly to the client. In addition, clients are aware that they will be charged separately for consulting fees. It provides the ability to bill your client for consultant fees as reimbursable expenses.

Do the following to add consultant services as a reimbursable expense:

Select Preferences from the master drop-down list.

Go to Billing > Billing Codes.

Select Expense from the Account Codes drop-down list.

Click Add

![]() and create an expense account code for your consultants. You can create

one category (for example, Consultant) or break it down into consultant

types (for example, Structural Engineer, MEP,

Civil Engineer, etc.). You can also identify them by name (for example,

Cagel Engineering, Michelson

Engineering, and A & E Consultants).

and create an expense account code for your consultants. You can create

one category (for example, Consultant) or break it down into consultant

types (for example, Structural Engineer, MEP,

Civil Engineer, etc.). You can also identify them by name (for example,

Cagel Engineering, Michelson

Engineering, and A & E Consultants).

When you receive a bill from your consultant, navigate to the Time/Expense module and create an expense entry for the project.

Choose the consultant account code created

in step 4 from the Expense Type

drop-down list. This expense entry will appear on the invoice as a

reimbursable expense including the markup, if applicable.

Clear the Apply Markup check box if you want to extend the consulting expense to your client without a markup.

This method is useful when a contract requires that consultant services are to be paid by the architect and not passed on to the client as a reimbursable expense. In this situation, the client might or might not know the specific fees for consultants as they are negotiated between the consultant and architect. This method provides the ability to bill your client a stipulated sum by phase, without specifically identifying the consultant portion of each fee. It also allows you to track the consultant fees separate from your fees.

Do the following to track consultant expenses:

Click Projects on the navigation bar.

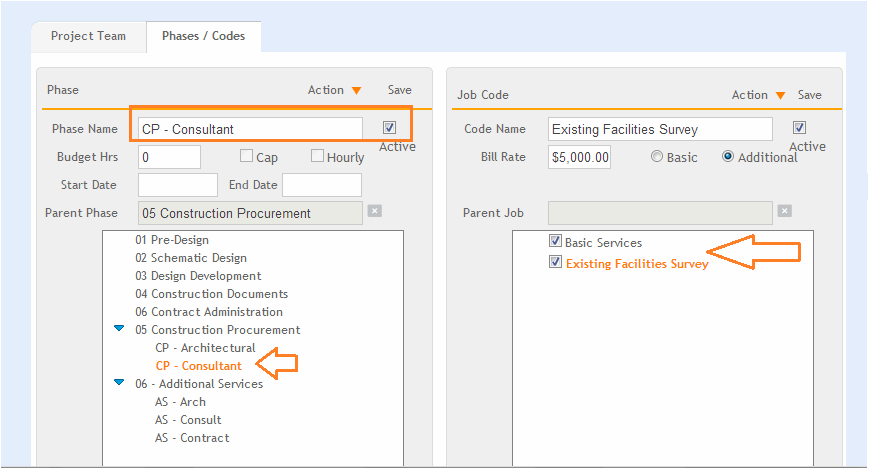

Click a listed project to edit and then click the Phases/Codes tab.

Add a sub-phase to each main phase for your consultants (for example, Structural Engineering) and also an architectural sub-phase to track your services separately.

Select the Active

check box for job codes for each sub-phase.

You can also create a job code specifically for consultants, especially if the contract has services that might be basic and others that are hourly- even though they can't be passed on to the client. Check the appropriate job codes for this phase to track consultant services separately.

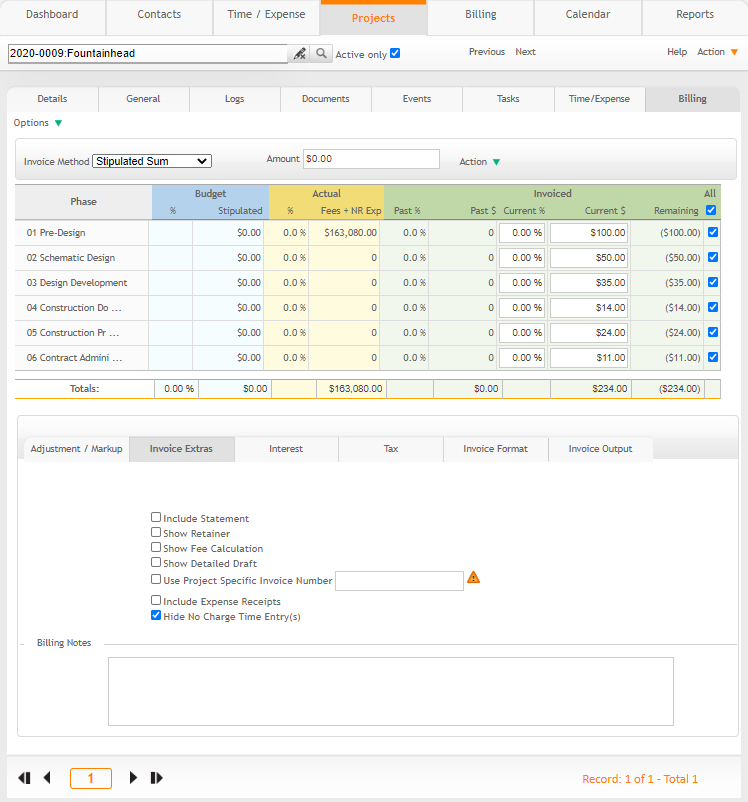

Go to the Projects-Billing view, and select Budgets from the drop-down list.

Create a budget for the consultant fees accordingly. Click on the phase name to expand the sub-phase list.

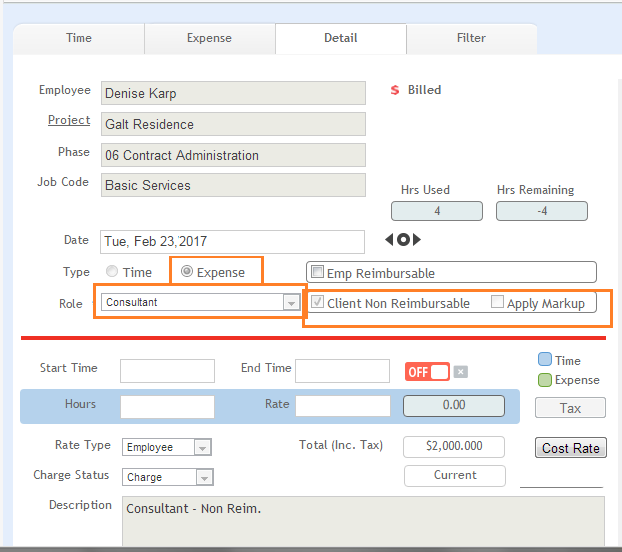

When you receive a bill from your consultant, go to the Time/Expense -Detail screen and create an expense entry for the project.

Select the Non-Reimbursable check box. This ensures the expense entry is applied against the stipulated fee for the phase and not charged to the client as a reimbursable expense.

Continuing on the Projects

-Billing view, select Summary

from the drop-down list. The consultant fees can be tracked separate

from your fee on this screen. The Consultant

non-reimbursable expense entry is tracked separately from your architectural

time/fee.

Click on the phase name to expand the sub-phase list.

Continuing on the Projects-Billing View, select Options from the drop-down list.

To bill the client, expand the phase and

enter the fee amount to be invoiced and then collapse the phase.

Your client will see the fees due for the entire phase, with all the sub-phase fees rolled up into the main-phase. If you want to show the phase and sub-phases on the invoice, keep the sub-phases expanded before generating the invoice.